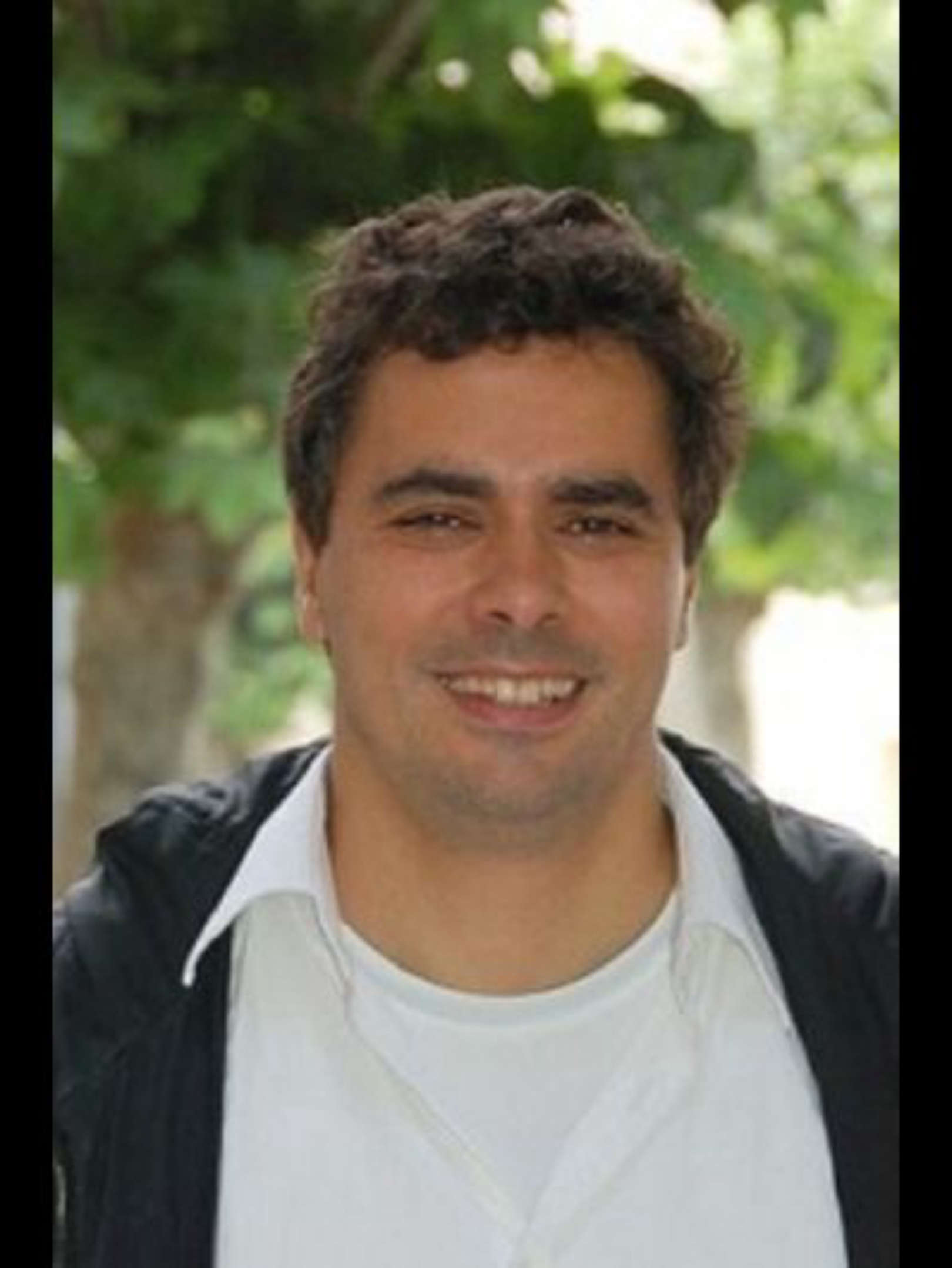

About

Alberto A. Pinto is a full professor at the Department of Mathematics, Faculty of Sciences, University of Porto (Portugal). He is a researcher at the Laboratory of Artificial Intelligence and Decision Support, Institute for Systems and Computer Engineering LIAAD, INESC TEC. He is the founder and co-editor-in-chief (with michel benaim) of the Journal of Dynamics and Games, published by the American Institute of Mathematical Sciences (AIMS). He was the President of International Center for Mathematics (CIM) from 2011 to 2016. Since 2016 he is President of the General Assembly of CIM.

Alberto A. Pinto worked with David Rand at the University of Warwick, UK, on his master's thesis (1989) that studied the work of Feigenbaum and Sullivan on scaling functions and he went on to a PhD (1991) on the universality features of other classes of maps that form the boundary between order and chaos.

During this time Alberto A. Pinto met a number of the leaders in dynamical systems, notably Dennis Sullivan and Mauricio Peixoto, and this had a great impact on his career. As a result he and his collaborators have made many important contributions to the study of the fine-scale structure of dynamical systems and this has appeared in leading journals and in his book "Fine Structures of Hyperbolic Diffeomorphisms" (2010) coauthored with Flávio Ferreira and David Rand.

While a postdoc with Dennis Sullivan at the Graduate Center of the City University of New York he met Edson de Faria and through Mauricio Peixoto he got in contact with Welington de Melo. With de Melo he proved the rigidity of smooth unimodal maps in the boundary between chaos and order extending the work of MacMullen. Furthermore, de Faria, de Melo and Alberto A. Pinto proved the conjecture raised in 1978 in the work of Feigenbaum and Coullet-Tresser which the characterizes the period-doubling boundary between chaos and order for unimodal maps. This appeared in the research article “Global Hyperbolicity of Renormalization for Smooth Unimodal Mappings” published at the journal Annals of Mathematics (2006) and was based in particular in the previous works of Sandy Davie, Dennis Sullivan, Curtis McMullen and Mikhail Lyubich.

Since then Alberto Pinto has branched out into more applied areas. He has contributed across a remarkably broad area of science including optics, game theory and mathematical economics, finance, immunology, epidemiology, and climate and energy. In these applied areas, he has published widely overpassing more than one hundred scientific articles. He edited two volumes, with Mauricio Peixoto and David Rand, untitled “Dynamics and Games I and II” (2011). These two volumes initiated the new Springer Proceedings in Mathematics series. He edited with David Zilberman the volume untitled “Optimization, Dynamics, Modeling and Bioeconomy I” (2015) that also appeared at Springer Proceedings in Mathematics & Statistics series. While President of CIM, with Jean-Pierre Bourguignon, Rolf Jeltsch and Marcelo Viana, he edited the books "Dynamics, Games and Science" and "Mathematics of Planet Earth" that initiated the "CIM Series in Mathematical Sciences", published by Springer-Verlag. He edited, with J. F. Oliveira and J. P. Almeida, the book "Operational Research", published by Springer-Verlag at the CIM Series in Mathematical Sciences". he edited, with Lluís Alsedà, Jim Cushing and Saber Elaydi, the book "Difference Equations, Discrete Dynamical Systems and Applications", published at the Springer Proceedings in Mathematics & Statistics. He published, with Elvio Accinelli Gamba, Athanasios N. Yannacopoulos and Carlos Hervés-Beloso, the book "Trends in Mathematical Economics", published by Springer-Verlag.

Alberto A. Pinto with Michel Benaim founded the Journal of Dynamics and Games (2014) of the American Institute of Mathematical Sciences (AIMS) and currently they are the editors-in-chief of the journal. He has also increasingly taken on important administrative tasks. He was a member of the steering committee of Prodyn at the European Science Foundation (1999-2001). He was the executive coordinator (2009-2010) of the Scientific Council of Exact Sciences and Engineering at the Fundação para a Ciência e Tecnologia.