Sobre

Alberto A. Pinto é professor Catedrático do Departamento de Matemática, Faculdade de Ciências, Universidade do Porto (Portugal). É investigador no Laboratório de Inteligência Artificial e Apoio à Decisão (LIAAD) do INESC TEC.

Foi o fundador e é actualmente o co-editor-em-chefe, juntamente com Michel Benaim da Université de Neuchatel, Suiça, do Journal of Dynamics and Games, publicado pelo American Institute of Mathematical Sciences (AIMS). Foi presidente do Centro Internacional de Matemática (CIM) de 2011 a 2016. Desde 2016 preside à Assembleia Geral do CIM.

Alberto Pinto iniciou a sua carreira científica sob a orientação de David Rand (U Warwick, UK). Na sua tese de mestrado (1989) estudou os trabalhos de Feigenbaum e Sullivan em funções scaling. Continuando os seus trabalhos sob a orientação de David Rand, estudo na sua tese de doutoramento (1991) características de universalidade de outras classes de aplicações que formam a fronteira entre ordem e caos.

Durante esse período, Alberto Pinto conheceu vários investigadores de topo na área de Sistemas Dinâmicos, nomeadamente Dennis Sullivan (Stony Brook, NY, EUA) e Mauricio Peixoto (IMPA, Brasil), e isso teve um grande impacto na sua carreira. Como resultado, ele e seus colaboradores fizeram várias contribuições importantes para o estudo da estrutura em escala fina de sistemas dinâmicos, tendo esses trabalhos sido publicados em destacados jornais científicos internacionais e no livro Fine Structures of Hyperbolic Diffeomorphisms em co-autoria com Flávio Ferreira e David Rand, publicado na prestigiada série Springer Monographs in Mathematics, da Springer Verlag.

Enquanto realizava um pós-doutoramento sob a supervisão de Dennis Sullivan no Graduate Center da City University of New York (CUNY), conheceu Edson de Faria e, através de Mauricio Peixoto, entrou em contato com Welington de Melo. Com de Melo provou a rigidez de aplicações unimodais suaves na fronteira entre caos e ordem, estendendo o trabalho de C. T McMullen (UHarvard), laureado em 1998 com a Medalha Fields. Conjuntamente com Edson de Faria e Welington de Melo, Alberto Pinto provou uma conjectura de Feigenbaum e Coullet-Tresser que caracteriza a duplicação do período entre o caos e a ordem para aplicações unimodais. Este resultado surge no artigo Global Hyperbolicity of Renormalization for Smooth Unimodal Mappings publicado na revista Annals of Mathematics (2006) e teve como base resultados anteriores de Sandy Davie, Dennis Sullivan, Curtis McMullen e Mikhail Lyubich.

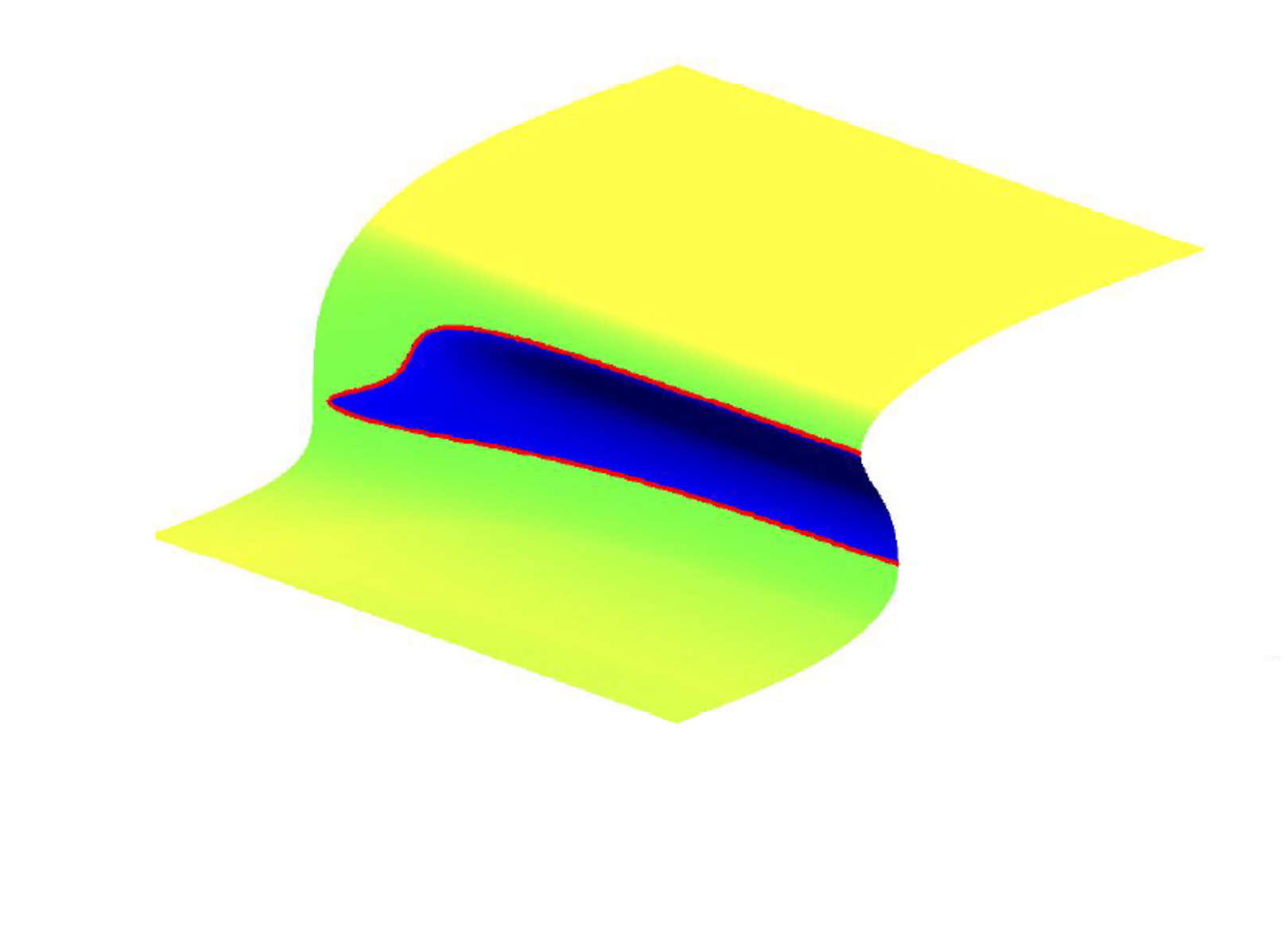

Desde então, Alberto Pinto alargou os seus interesse de investigação a áreas mais aplicadas da Matemática, tendo feito contribuições em vastas e variadas incluindo ótica, teoria dos jogos e economia matemática, finanças, imunologia, epidemiologia e clima e energia. Nessas áreas aplicadas, ele publicou amplamente ultrapassando os cem artigos científicos.

Alberto pinto editou dois volumes, com Mauricio Peixoto e David Rand, Dynamics and Games I and II (2011). Estes dois volumes iniciaram a nova série Springer Proceedings in Mathematics. Com David Zilberman (U Berkeley) editou os volumes Modeling, Dynamics, Optimization and Bioeconomics I and II (2015, 2017) também na série Springer Proceedings in Mathematics & Statistics. Ainda na mesma série editou conjuntamente com Lluís Alsedà, Jim Cushing e Saber Elaydi, o livro Difference Equations, Discrete Dynamical Systems and Applications.

Enquanto presidente do CIM, editou conjuntamente com Jean-Pierre Bourguignon (European Research Council-ERC), Rolf Jeltsch (ETH-Zurich) e Marcelo Viana (IMPA), os livros Dynamics, Games and Science e Mathematics of Planet Earth que iniciaram a CIM Series in Mathematical Sciences, publicado pela Springer Verlag. Na mesma série, editou com J.F. Oliveira e J.P. Almeida o livro Operational Research. Na área da Economia Matemática, editou com Elvio Accinelli Gamba, Athanasios N. Yannacopoulos e Carlos Hervés-Beloso, o livro Trends in Mathematical Economics (2017), também publicado pela Springer Verlag.

Alberto Pinto desempenhou ainda funções como membro da Direção do projeto Internacional Pobabilistic Methods in Non-Hyperbolic Dynamics (PRODYN), financiado pela European Science Foundation (1999-2001). Desempenhou ainda funções como Coordenador Executivo (2009-2010) do Conselho Científico de Ciências Exatas e Engenharia da Fundação para Ciência e Tecnologia.